AUSTIN, Texas — In this week's edition of Texas This Week, Dale Craymer, president of the Texas Taxpayers and Research Association, breaks down the amendments to the Texas Constitution on the May 7 ballot and how they could save homeowners money.

Three things to know in Texas politics

1. Experts: Gov. Abbott's border inspections cost economy nearly $9 billion

Gov. Greg Abbott's directive for DPS troopers to stop and inspect commercial trucks crossing into the U.S. at the Texas-Mexico border has ended, but the effects to the economy could be felt for some time. Truckers were left waiting at the border for hours, some running out of gas, as their products, including produce, just sat there. The Perryman Group, a Texas-based economic research and analysis firm, estimates the slowdown cost the country $8.9 billion in GDP. For each day trucks sat at the border, the daily loss to the gross domestic product was $470.3 million. The stops, which were intended to stop drug smuggling and human trafficking, instead only turned up vehicle violations such as under-inflated tires and oil leaks. The Texas Tribune reports zero drugs, weapons or contraband was found.

2. Former Texas Senn Wendy Davis sues Texas over abortion rights

Former Texas Sen. Wendy Davis has filed a federal lawsuit challenging Texas' near-total ban on abortion. Senate Bill 8 bans doctors from performing abortions once fetal cardiac activity is detected – that's typically at 6-weeks gestation, before many women know they are pregnant. The law makes no exceptions for victims of rape or incest, only if a woman's life is in danger. Violating the law isn't a criminal offense, instead almost anyone can sue someone who "aides and abets" a woman in getting an abortion and be awarded $10,000. Davis' lawsuit claims abortion funds, groups that financially help women gain access to abortions, are being harassed unconstitutionally. Other plaintiffs in the suit say they stopped giving to these funds after a Texas lawmaker sent cease and desist letters to the funds citing Senate Bill 8 and an older Texas law. The goal of the lawsuit is to declare both laws unconstitutional.

3. Texas sues Biden Administration to keep Title 42

Texas is trying to stop the Biden Administration from ending Title 42. The policy allowed federal immigration officials to turn migrants away at the border because of the COVID-19 pandemic. The order was enacted in March 2020 at the beginning of the pandemic and is set to expire on May 23. Texas Attorney General Ken Paxton filed a lawsuit Friday aimed at keeping the policy in place.

Dale Craymer on statewide constitutional amendments

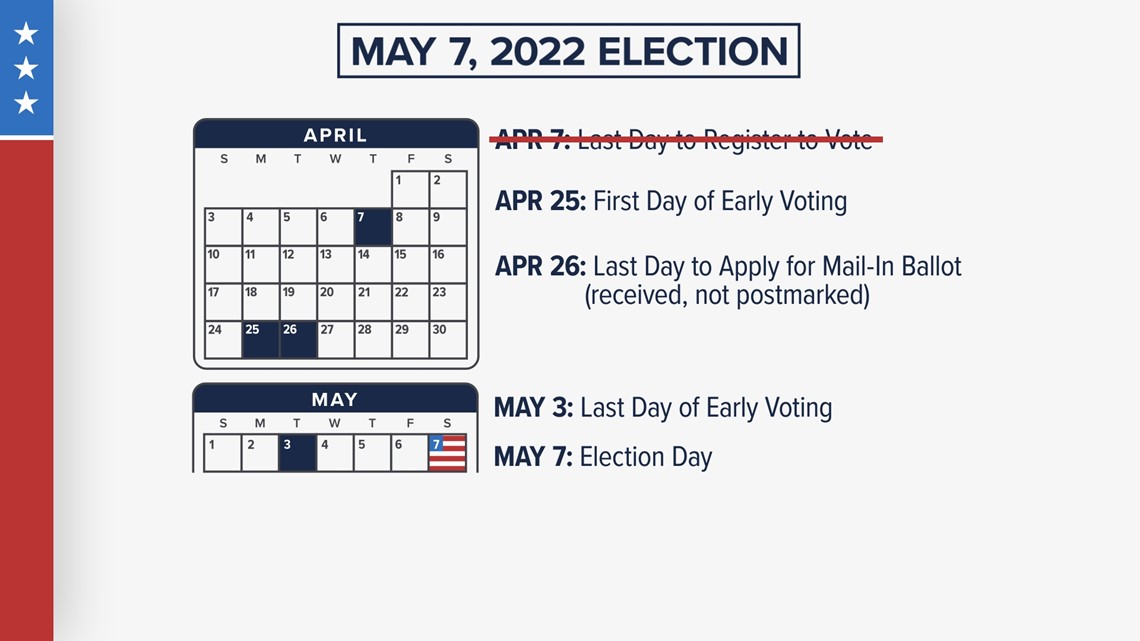

May is a busy month for Texas voters. The primary runoff election is May 24 and, on May 7, voters will weigh in on local elections, such as city council seats, school board bonds and city propositions, along with two amendments to the state constitution, both aimed at offering property tax relief. Early voting in that election starts Monday, April 25. Dale Craymer, president of the Texas Taxpayers and Research Association, joined Ashley Goudeau to explain how the statewide amendments could impact your tax bill.

Ashley Goudeau: For folks who don't know, tell us what exactly is the Texas Taxpayers and Research Association?

Dale Craymer: "We're a nonprofit membership organization. Most of our members tend to be businesses that have a large presence in Texas."

Goudeau: And you all talk all things taxes, especially when it comes to what's in the best interest of taxpayers, right?

Craymer: "Absolutely. We focus on taxes, which is why I don't get invited to a lot of parties. This is generally what we like to talk about, what we like to focus on."

Goudeau: All right. Well, taxes are the main topic of discussion for statewide voters on the May 7 election. I want to talk about the propositions and kind of explain what they are, so I'm going to read each one.

Let's start with prop one:

The constitutional amendment authorizing the Legislature to provide for the reduction of the amount of a limitation on the total amount of ad valorem taxes that may be imposed for general elementary and secondary public school purposes on the residence homestead of a person who is elderly or disabled to reflect any statutory reduction from the preceding tax year in the maximum compressed rate of the maintenance and operation taxes imposed for those purposes on the homestead.

What a mouthful. Also, a lot for folks to digest, so, make it easy for us Dale, what is a prop one about?

Craymer: "It is clear as mud, unfortunately, very technical language. But in effect, Ashley, what, in Texas, once you turn 65, your school taxes or capped at whatever you paid in that year. So folks who are over 65 or who are disabled, their school taxes are capped. But what happened in 2019, the Legislature passed an initiative that's starting to push school tax rates down. But a lot of those folks are capped at higher tax rates that were in effect years ago. But what this does, what this amendment does, basically, is it extends tax relief to those folks who are capped by letting their tax bills drift down as school tax rates come down."

Goudeau: Let's talk about Prop two. This one is a little easier to to understand and digest.

It's the constitutional amendment increasing the amount of the residence homestead exemption for ad valorem taxation for public school purposes from $25,000 to $40,000.

Talk to us about what this would do.

Craymer: "And this one has a broader impact. This is going to apply to all homeowners, whereas Prop 1 only applies to folks who are 65 or older or who are disabled. But what Prop 2 does is it increases the current homestead exemption. Right now, if your home is valued at $400,000, the homestead exemption exempts $25,000 of that, so you're only taxed on a value of $375,000. The Legislature wants to raise that to $40,000, and so it's increasing the amount of the exemption. It's going to save homeowners money. The average homeowner, if this passes, is going to see their tax bill be about $180 less this coming October than what it will be if this does not pass. So, basically, the second proposition is property tax relief for all homeowners."

Goudeau: And so when we look at it, some would say, 'But is this going to be at the cost of schools?' We know that in Texas, we largely fund our public schools through our property taxes. So how is this going to impact the school districts?

Craymer: "That's an excellent question. If this passes, it is not going to harm schools in any way. Schools are basically guaranteed a certain dollar amount of funding per student in our school finance formulas. And should these propositions pass, the state will make that money up through the formulas. It's not going to result in any loss of revenue to our schools."

Goudeau: Now that sounds good on the front end, right Dale, when we talk about the State is going to make up that money, where's the State going to get that money from?

Craymer: "Well, right now, the State has a $12 billion surplus, which is about 10%, so it's a sizable surplus. But within the grand scheme of the budget, truth of the matter is these propositions don't cost a whole lot of money. So there is no problem in continuing funding for these into perpetuity."

Goudeau: Dale, this is all happening as lawmakers are trying to find ways to offer Texans property tax relief. Let's talk about that a bit. How big is the property tax burden for Texas homeowners?

Craymer: "Well, Texas property tax rates are among the highest in the nation. For a homeowner, our tax rates probably run us around 12th highest among the states. It's a little different, a little more for industrial properties. We rank about seventh highest. But our high property taxes is one of the prices we pay for not having a personal income tax in the state. So as painful as those property tax bills are, given that you're not having to write a personal income tax check, the numbers still work out better for you in Texas."

Goudeau: Talk to us about the process, because it gets a lot of pushback in terms of property appraisals. These appraisals increased significantly all across the state, though, right?

Craymer: "They really did. And, in all honesty, that is simply a reflection of the real estate market right now. In Texas, we value property at its market value – what the appraiser thinks that home will sell for. But I know folks are very concerned about their appraisals. The one thing I can tell you is your appraisal increase is not going to translate into a commensurate increase in your tax bill for a couple of reasons. One is because of legislation that passed in 2019 – as values rise, as the City of Austin, for example, as the amount of taxable value subject to tax rises, the City is required to reduce its tax rate so that it doesn't raise any more than three and a half percent more money. So if you're looking at like a 30% increase in the tax base, that means your tax rates probably going to have to drop about 25%, 27%. That's going to save homeowners a lot and businesses as well. Plus homeowners have additional protections in that any value increase in excess of 10% is exempt. So the most your taxable appraisal can go up is 10%. So the third thing that will help you is if those two ballot propositions pass at that homestead exemption increases, that's going to save taxpayers money as well. So I know everyone's freaking out about their appraisals right now, but I can assure you, we're not going to see that kind of increase in tax bills ... The truth of the matter is the appraisal doesn't really determine your tax bill. Right now, everybody's tax bill is zero. Those tax bills don't finalize until cities and counties and the school district adopt their tax rates later this summer. So just because you think you get your appraisal under control, folks need to pay attention to the tax rates that jurisdictions adopt because that's what's really driving their tax bills. If local districts didn't want more money to spend, our tax bills would increase regardless of what our appraisals are."

Key May 7 election dates:

You can find more information on voting in the KVUE voter guide: