BEAUMONT, Texas — The property tax relief bill on the November 7th ballot could be the biggest tax break in Texas history for homeowners.

Some homeowners are pretty excited about Proposition 4. It even has the backing of some big names like Speaker of the House Dade Phelan.

From homeowners insurance to higher cost of living, it's expensive to own a home right now but Proposition 4 could help.

"Highly recommend taxpayers, homeowners go out and vote," said Phelan.

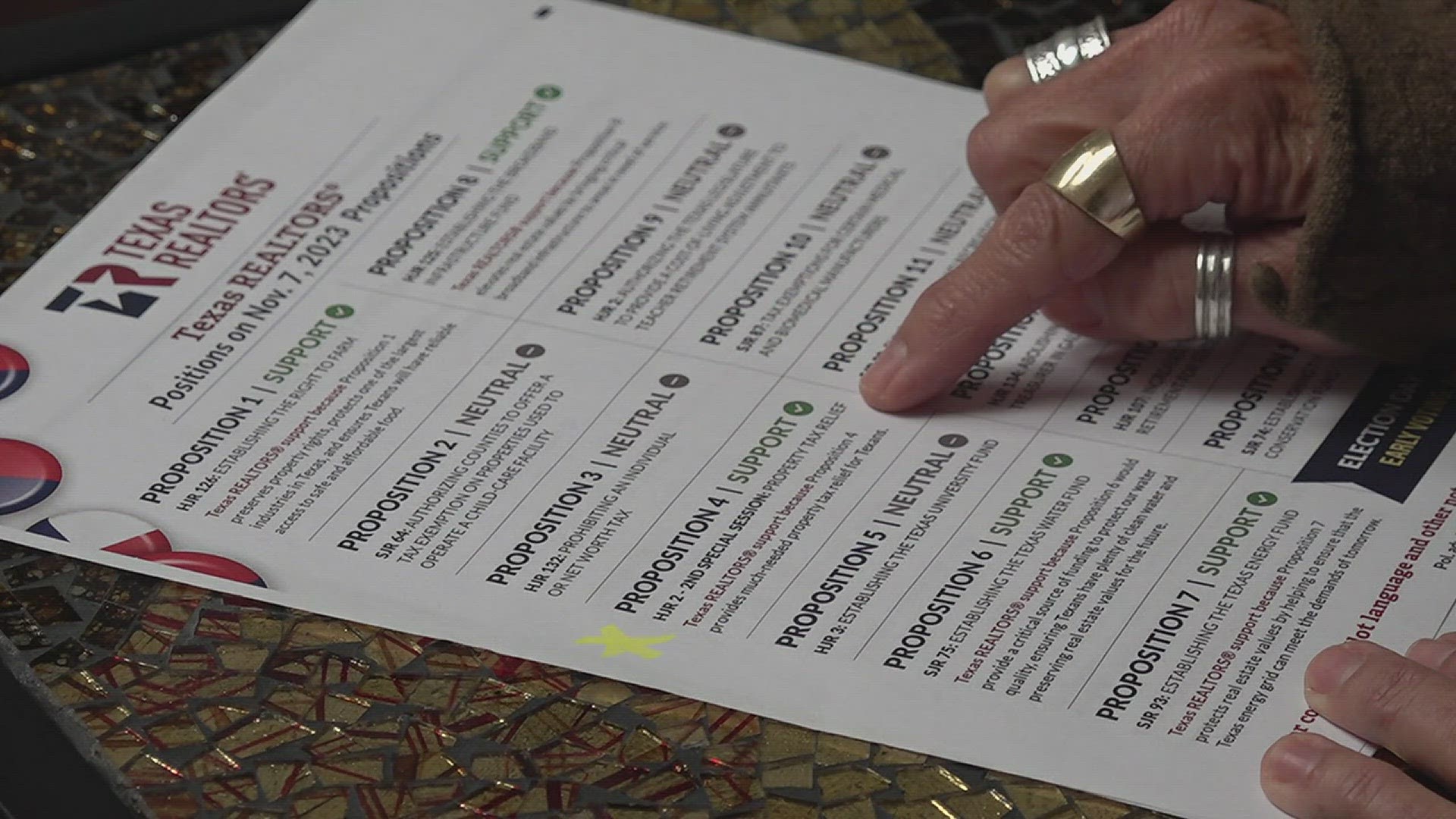

This new bill has been a hot topic within the real estate community.

"In this economy we need as much relief as possible," said RE/MAX Team Lead Dana Archibald.

Proposition 4 is one of the many state propositions on the ballot this election cycle and it could mean some major savings for homeowners.

"It's going to increase your homestead from $40,000 dollars to $100,000," Phelan said.

However, there are some exceptions.

It's only for a primary residence, so if you own more than one home not all of them will be covered.

This also means that your local school district won't receive any money from that homestead either.

"Rate compression, which means the State of Texas is gonna pay for more of the homeowners property taxes. When it comes to schools districts. Which is the largest portions of your tax bill. And then it's gonna be some appraisal reforms, and some kind of accountability reforms that's also gonna be in prop four too," said Phelan.

There are even bigger benefits for homeowners 65 and over, of if they are disabled. They can get an extra $10,000 in savings.

"And that's significant. What could you do with that money as a homeowner? Reinvest it in your property, take care of your family. It's a big win," Archibald said.

Speaker Phelan said the average homeowner can see a savings of around $1,300 a year.

If Proposition 4 passes, it would go into effect for the 2023 property tax season.

Also on 12NewsNow.com...