BEAUMONT, Texas — The hot housing market has the rest of us paying a price.

Home appraisal values keep climbing, and that means most of us are paying more in taxes. To sum it up, the market is hot right now, according to one local realtor.

As the value of your home climbs, so does the amount your pay in property taxes.

Here is how you can protest.

Like any other product, the housing market is about supply and demand.

“It is a great time to sell. Sellers are getting more for their homes,” said local realtor Tania Castelan said.

She said for sellers, it's a good thing to see your home value increase.

But for those who are staying put in their homes, they have a price to pay.

“Pretty much in all areas of taxes are going up. So, as taxes go up, the values of homes go up,” Castelan said.

According to Texas Realtors, the median sale price for homes in Texas increased 18.6% in the first quarter of 2022.

Those market prices factor into the appraised value of your home. Jefferson County's Chief Appraisal Officer, Angela Bellard, said property owners have a right to protest.

“The appraisal notices went out in the mail, went out on all the residential properties and the locally appraised commercial,” Bellard said.

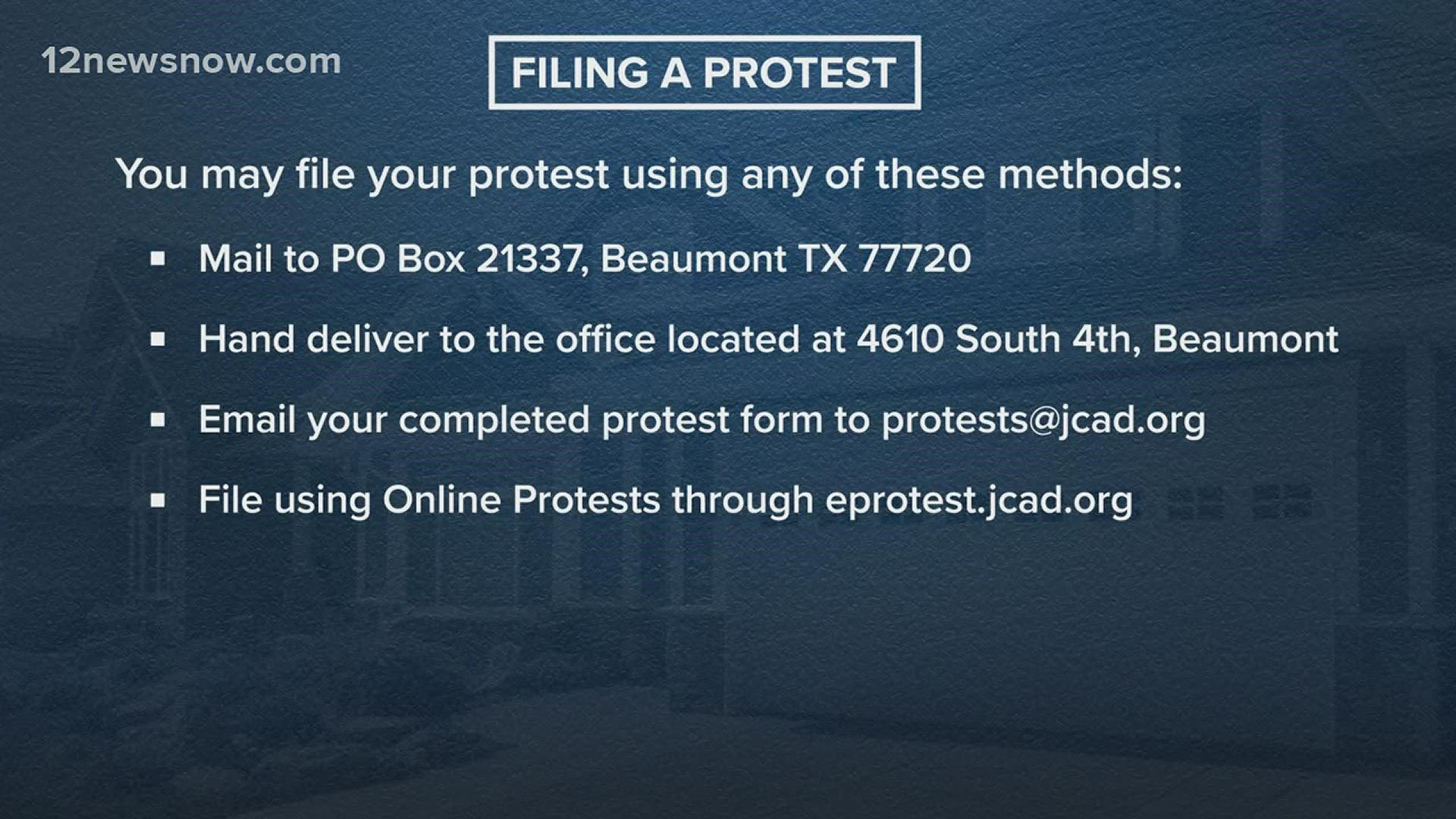

Once you receive your appraisal notice, you'll be given four ways to protest.

“They can mail that in, they can go online and fill it out online and it will get to us electronically,” Bellard said. “They can come in the office. Whichever method works best for them.”

Bellard said appraised values are based on market prices for the previous year and the first quarter of the current year.

“If we start seeing a decline in the market with interest rates going up, then that will impact the values for next year,” Bellard said.

Castelan said typically homeowners will call their real state agent to see what their house would be worth before going to the appraisal district.

“Let them know like ‘Hey, I shouldn't be taxed this much’ or ‘they're wanting to debate or dispute the taxes,’” Castelan said.

If you think you are paying too much on your property taxes, May 16 is the deadline to protest appraised values.