DALLAS — Soon, summer will end and kids will go back to school. Parents can take advantage of Texas' sales tax holiday to save big on back-to-school supplies.

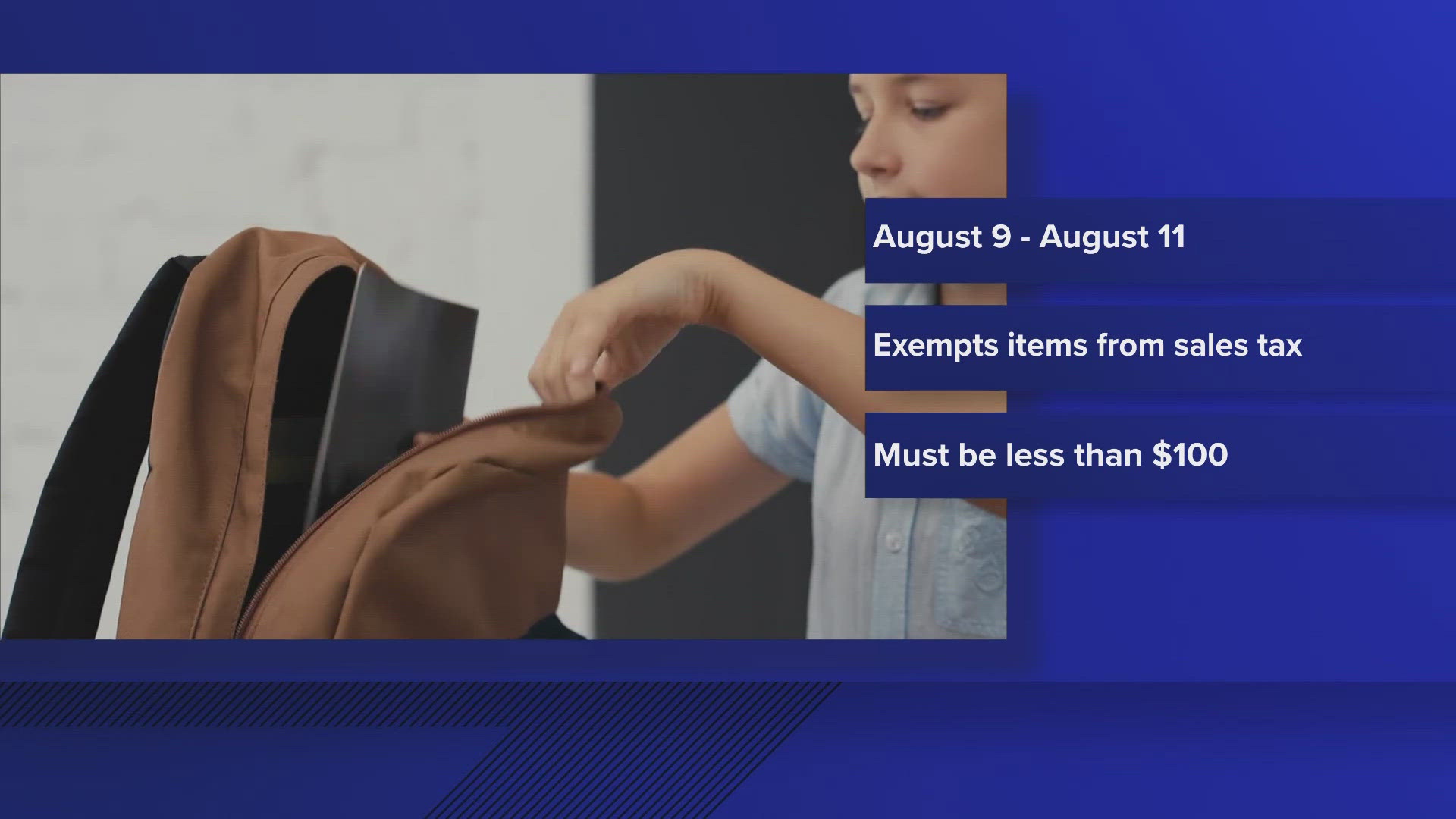

This year’s sale tax holiday begins Friday, Aug. 9, and goes through midnight Sunday, Aug. 11.

The sales tax holiday exempts qualifying items from sales tax when purchased between those days.

Items that qualify

During tax-free weekend, most shoes, clothes and school supplies are sold tax-free as long as they are less than $100. There is no limit on the number of eligible items you can buy.

For a full list of qualifying school supplies click here.

For a full list of qualifying clothing items click here.

Items that do not qualify

- items sold for $100 or more

- clothing subscription boxes

- specially-designed athletic activity or protective-use clothing or footwear

- For example, golf cleats and football pads are usually worn only when people play golf or football, so they do not qualify for the exemption.

- Tennis shoes, jogging suits and swimsuits, however, can be worn for other than athletic activity and qualify for the exemption.

- clothing or footwear rentals, alterations (including embroidery) and cleaning services

- items used to make or repair clothing, such as fabric, thread, yarn, buttons, snaps, hooks and zippers

- jewelry, handbags, purses, briefcases, luggage, umbrellas, wallets, watches and other accessories

- computers

- software

- textbooks

- framed backpacks

- luggage

- briefcases

- athletic, duffle or gym bags

- computer bags

- purses

Online purchases

During the sales tax holiday, qualifying items can be bought in-store, online, by mail or by any other means. However, the sale of the item must take place during the three-day period.

For example, if a purchaser enters their credit card information in an online shopping website on Sunday, Aug. 11, 2024, at 5:00 p.m. to purchase qualifying school supplies, but the school supplies will not be shipped until Friday, Aug. 16, 2024, and will not arrive until Tuesday, Aug. 20, the purchase will still qualify for the exemption.

Delivery, shipping, handling and transportation charges

Since shipping and handling prices are part of the seller's price, it may affect whether an item can be eligible for sales tax exemption during the holiday.

For example, if you buy an item for $95, but a $10 delivery charge makes the total price $105, the item would no longer be exempt from sales tax.

If a delivery charge is billed per item, and an invoice has both exempt and taxable items, only the qualifying exempt item’s delivery charge is exempt.

Requesting a sales tax holiday refund

If you pay sales tax on qualifying items during the sales tax holiday, you can ask the seller for a refund of the tax paid. The seller can either grant the refund or provide their customer with Form 00-985, Assignment to Right to Refund (PDF), which allows the purchaser to file the refund claim directly with the Comptroller’s office.