BEAUMONT, Texas — The Senate gave final approval to a debt ceiling deal on Thursday, sending it to President Joe Biden's desk to become law.

The deal suspends the nation's debt ceiling into January 2025, meaning the U.S. will avoid a potentially catastrophic default on its financial obligations.

The Biden Administration's plan for student debt forgiveness is currently being considered by the U.S. Supreme Court, and its decision is likely to come as soon as later this month.

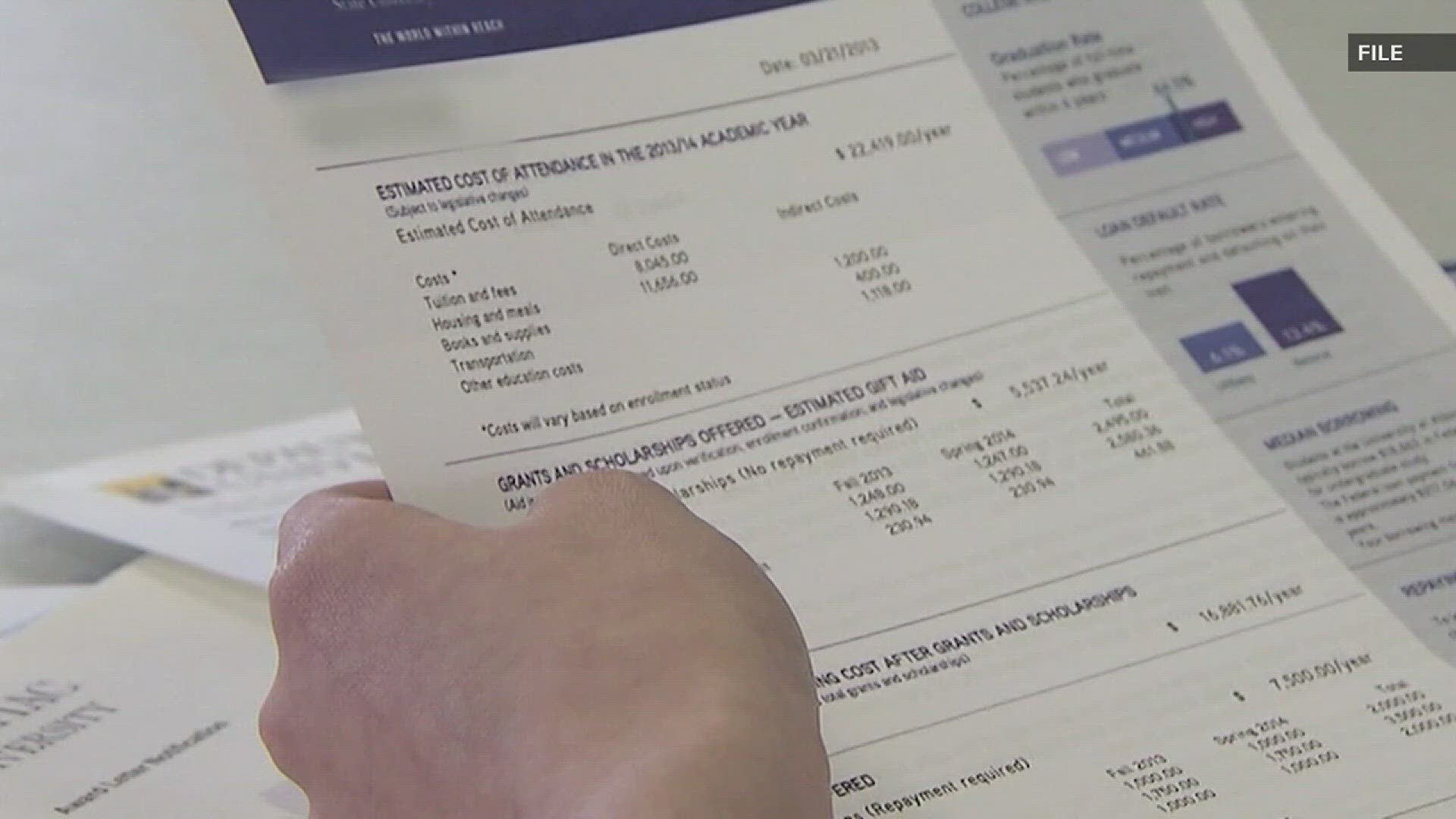

Lamar University nursing students Autumn Johnson and Lindsey Lafleur were shocked to learn that student loan payments are restarting soon.

"I didn't notice the three year pause was going to end so soon," Johnson said.

Payments are expected to resume 60 days after June 30, 2023.

"I think in that time period there should have been a way to figure out how to help students," Lafleur said.

Political Science professor at Lamar Dr. James Nelson says requiring borrowers to start paying back student loans is part of a much bigger issue.

"The Biden administration wanted just a clean raise of the debt ceiling without out any concessions, however republicans in congress wanted some concessions out of this," Nelson said.

45 million Americans owe $1.6 trillion in student loans, according to the New York Times.

"When students repay their student loans, they're sending money back to the government which in some small way does contribute to preventing the growth of the debt," Nelson said.

Nelson says the debt ceiling decision didn't touch on Biden's student loan forgiveness program.

If the Supreme Court allows the Biden Administration's student debt relief plan to move forward, any Pell Grant recipient with more than $20,000 in federal student loan debt will begin repaying on the amount greater than $20,000. All non-Pell Grant recipients will begin repaying on the amount greater than $10,000.

"Eventually the Supreme Court will probably weigh in on whether that law referred to as the Hero's Act allows President Biden to forgive a certain amount of student loan debt or if that law is not applicable to that situation," Nelson said.

Johnson, a junior, and Lafleur, a senior, say they have a combined total of almost $10,000 in loans.

"To know that before I even have a house, I'll already have a bill at that three because I have three different loans, but I guess it's just apart of life. It's another obstacle," Johnson said.