BEAUMONT, Texas — As students at Lamar University pack up and move out, many are faced with a harsh reality.

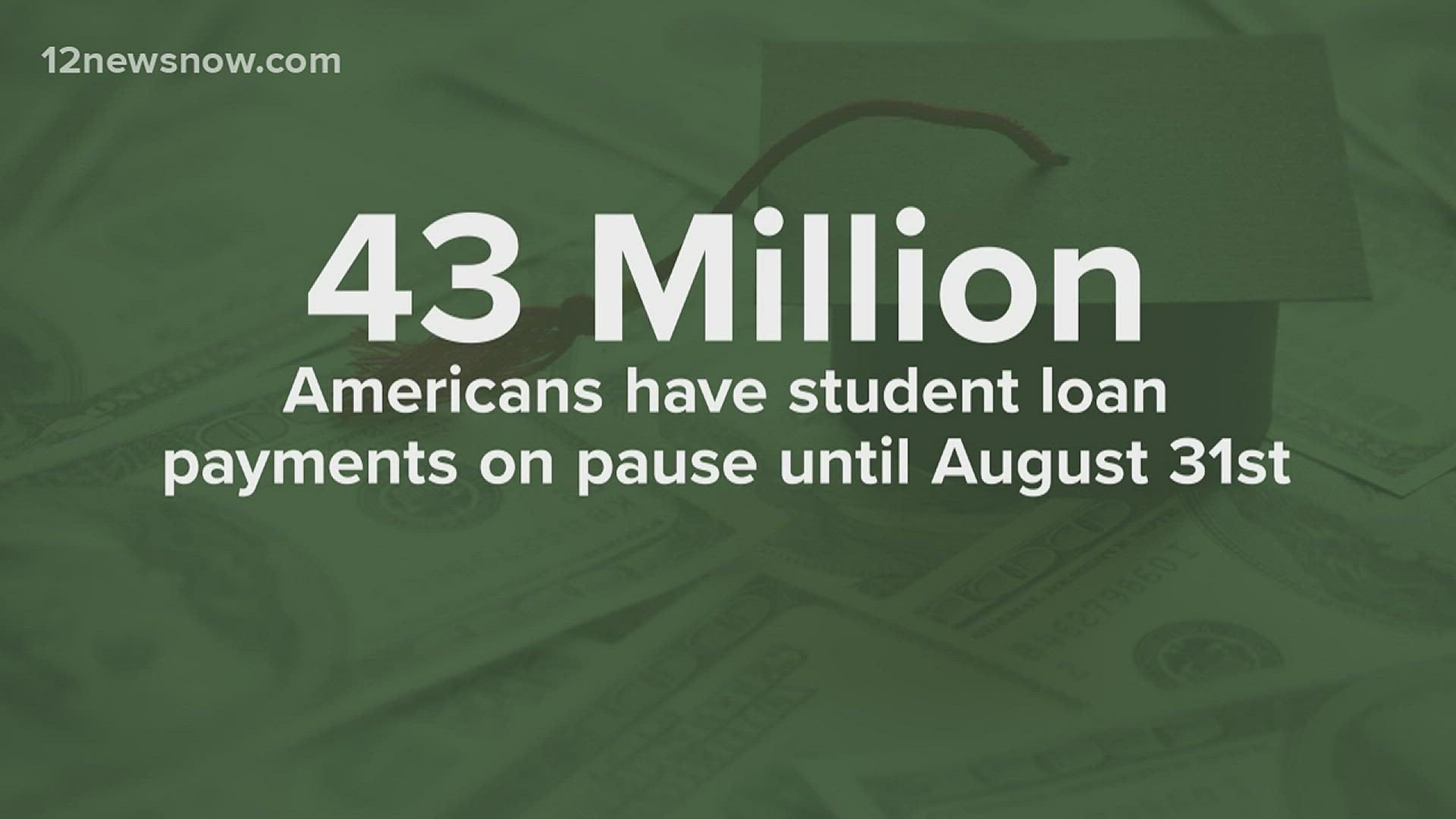

Student loan payments are piling up, and they aren't alone. More than 43 million Americans have student loan payments.

So, is there a way to take advantage of the pause?

It's not just students at Lamar University facing student loan debt. It's millions of Americans, and even though President Joe Biden put payments on pause, some experts say you shouldn't stop paying.

As student loan payments remain on pause for more than 43 million Americans, they are left with a choice.

"It’s kind of just a matter of continuing paying now, or put those payments off for later," said Madison Block, senior marketing communications associate with American Consumer Credit Counseling.

The American Consumer Credit Counselling is a non-profit helping people manage their debt.

"If and when those student loan payments do resume, that's something for people who haven't been paying on them need to kind of refactor and reconsider, as far as how they are going to fit that into their budgets," Block said.

With the pause, interest rates are currently at 0% on federal student loans.

Block said it creates a prime opportunity to cut into your debt.

"They're still paying off the principal amount that they owe, but instead of paying 20% interest, that interest rate gets lowered pretty significantly, so they're paying the debt off faster, and saving money in the process," Block said.

However, if you do have other high-interest loans, you may want to focus on those while student loans are on pause.

"That interest is going to keep accumulating, so it's probably good to nip that in the butt while you can," Block said.

When it comes to tackling debt, there are two methods to consider.

"Snowball method, which basically involves paying down each of your debts starting with your lowest balance and working your way up from there,” Block said. “And then there's the debt avalanche method, which you start by paying down the debt that has the highest interest rate and working your way down from there. That method will save you more money in the long run because you’re tackling the debt with the highest interest rate first."

And student loan payments impact credit. When they resume, it's important to stay on top of your deadlines.

"Pay on time, and if you pay when you’re supposed to, that should, in theory, help build your credit score because payment history is the most important factor that goes into determining your credit score," Block said.

Every financial situation is different. If you're interested in a free debt consultation you could visit Consumercredit.com.

Also on 12NewsNow.com...